Spain Tourist Taxes: Read This Before You Travel

Sarah Pardi - December 30, 2025

Home > Travel Requirements, Policy & Authorization > Spain Tourist Taxes: Read This Before You Travel

Share this post

According to Spain's National Institute of Statistics (Instituto Nacional de Estadística), 93.8 million people traveled to Spain in 2024.

For context, if you put that many people in a line, it would be over 35,000 miles long. It's a massive number.

Still, tourism continues to grow and expand in Spain, especially in major cities like Barcelona and islands like the Canaries and Ibiza.

While that growth is a welcome surge when it comes to Spain's economy, it also has its pain points for visitors, residents, and governments.

Facilitating services for that many people (on top of Spanish residents) is a Herculean task. Not to mention, the infrastructure has to be solid with continuous monitoring, maintenance, and improvements in order to keep everyone safe, secure, and happy.

One of the ways that countries support their tourism infrastructure is through taxing the tourists themselves, and this tends to be the case in areas of the world that see overwhelming migration, like Venice, Paris, and Santorini.

If you're traveling to Spain in the coming weeks or months, it's something that you should be aware of.

Spain's tourist taxes

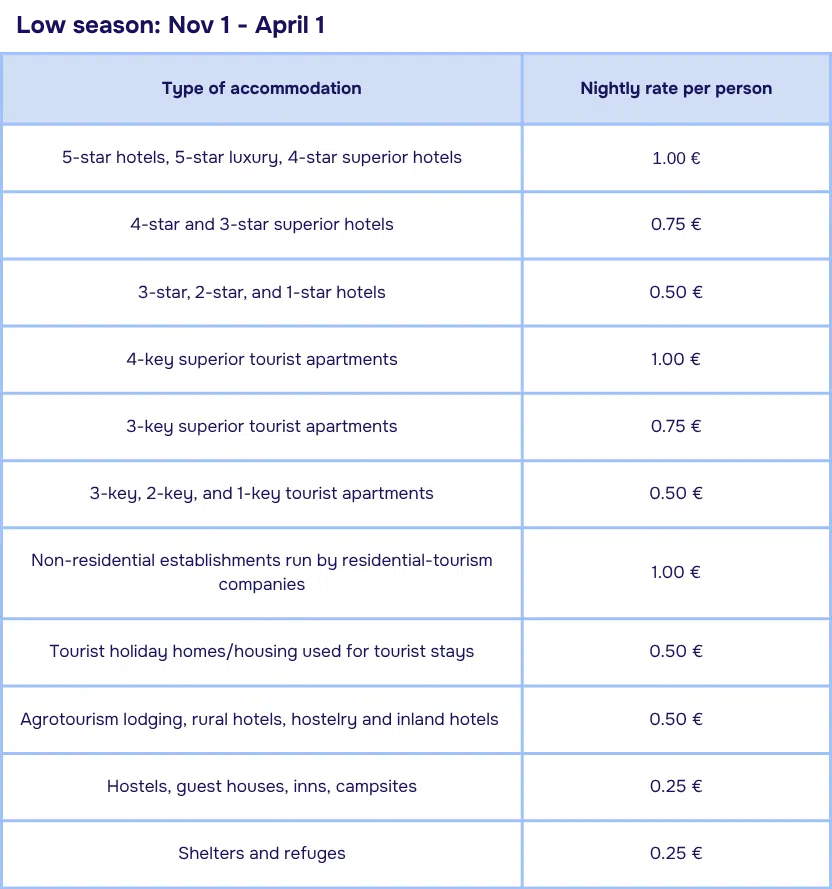

In most cases in Europe, tourist taxes are charged and paid when you (the tourist) stay at a hotel or other type of vacation accommodation.

Typically, it's a nightly rate that varies depending on the city/region you're in and the type of accommodation you're renting. This is the case for Spain, too.

Cruise-goers are also expected to pay a tourist tax, which usually differs in price.

Barcelona and Catalonia

Tourist taxes for Barcelona

Barcelona has seen some of the highest surges in vacationers, and therefore, the tourist taxes are some of the highest in the country.

Tourist taxes for Catalonia

You might be thinking, "Wait, isn't Barcelona in Catalonia?" and yes, you'd be right. That said, Barcelona's tourist taxes are higher than the rest of Catalonia, as it sees more tourism.

Heading to Spain? 🐂

Make sure your trip is covered with Travel Insurance for Spain

If you're staying anywhere else in the region, the taxes you can expect to pay are less than in Barcelona. They're charged in the same way, a nightly rate that is dependent on the type of lodging you book.

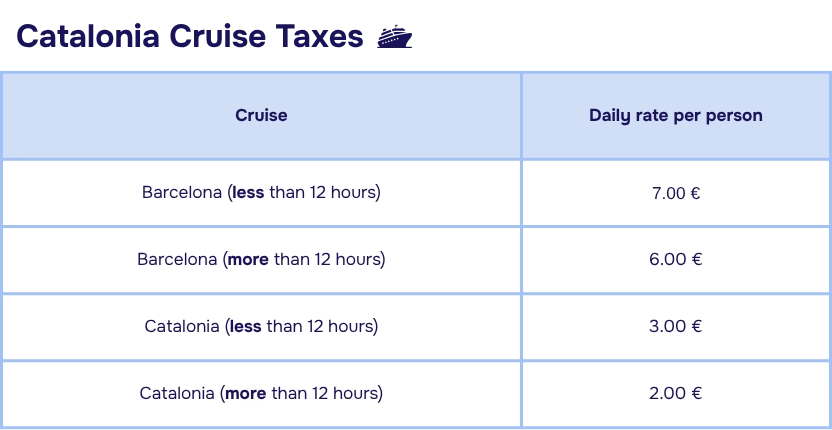

Cruise taxes for Barcelona and Catalonia

If your cruise is stopping in Barcelona and/or another port in the Catalonia region, you will also need to pay a tourist tax at a daily rate.

In the case of cruises, the rate doesn't depend on nightly stays (as often, port stops are just for the day). Instead, it depends on how many hours the ship will be docked.

Like with the nightly tax, Barcelona comes at a higher rate.

The Balearic Islands

This includes Ibiza, Menorca, Mallorca, and Formentera.

The Balearic Islands also charge their tourist tax at a nightly rate per person. Like the tax for Barcelona, it is dependent on the type of accommodation you're staying in.

Unlike Barcelona/Catalonia's tourism taxes, taxes for the Balearic Islands are adjusted depending on seasonality.

Cruise taxes for the Balearic Islands

If your cruise ship is stopping in Ibiza, Menorca, Mallorca, or Formentera, you will need to pay a flat-rate tourist tax.

Like other tourist taxes in the islands, cruise taxes are subject to seasonality.

Other locations in Spain

It's important to keep in mind that tourist taxes can change. Additionally, other locations in Spain can introduce tourist taxes.

Before your trip, make sure that you review the current tourist taxes on an official government website for the most up-to-date and accurate information.

There are some cities and regions in Spain in the process of implementing new tourist taxes, as well as others that are discussing the idea.

Paying your tourist tax

While no one enjoys taxes, tourist taxes are very easy to pay in Spain.

The accommodation you're staying at or the booking service you used is responsible for collecting your tax. You may be asked to pay it at the beginning of your stay, but more likely than not, it will be at the end.

Some accommodations may ask you to pay the tourist tax in cash, but oftentimes it can be charged to the card you used to pay for your lodging. If you're not sure, you can ask your accommodation so you can be prepared.

If you're taking a cruise, the cruise ship is responsible for collecting tourist taxes, and it is often added onto your bill. Again, you can ask your specific cruise line how they collect taxes.

Spain tourist taxes: Exemptions

There are a few exemptions when it comes to tourist taxes in Spain. The following visitors are exempt.

Barcelona and Catalonia exemptions

- Children under the age of 16.

- Stays due to force majeure.

- Stays due to health reasons.

- If you're a carer/caregiver to someone staying in Spain due to health reasons.

- Stays that are subsidized by EU social programs.

Balearic Island exemptions

- Children under the age of 16.

- Once you have stayed 9 days, the tax rate drops by 50% per night.

- Cruises: If your cruise ship's home port is in the Balearic Islands, you are exempt.

Related posts

Upcoming travels ? Get Insured !

Find the right insurance for your trip by using our powerful comparison tool!

Sarah Pardi - February 26, 2026

Sarah Pardi - February 19, 2026

Sarah Pardi - February 13, 2026

Sarah Pardi - February 12, 2026